Introduction

Agritourism is a fast growing sector of the tourism industry. Agritourism can be roughly defined as rural enterprises which both produce agricultural commodities and serve tourists. Examples include farm tours, horseback riding, climbing, petting zoos, educational demonstrations, hunting, fishing, hayrides and wine tasting. Agritourism may hold considerable economic potential for agricultural enterprises in Nevada, as well as for rural county economies in general.

As the emergence of the agritourism sector as a growth industry is relatively recent, statistics on the growth and size of the sector are just beginning to be collected. This factsheet presents some of the latest available data on agritourism revenues in Nevada, as well as other related agritourism data.

Current income from agritourism in Nevada appears to be modest. In 2002, 55 Nevada farm and ranch businesses in 12 counties reported deriving income from recreational sources, contributing a total of $442,000 (See Table 1). The 55 farms or ranches represent only 1.8% of the total number of farms or ranches in the state. For farms reporting recreation income the average received from this source was $8,000. Nevada counties with the largest number of farm or ranch businesses reporting income from recreational sources were Humboldt County (16), Elko County (9), White Pine County (7) and Washoe County (5). The largest income reported was in Elko County ($144,000), White Pine County ($115,000) and Humboldt County ($94,000). Washoe County reported an income of $35,000 from farmrelated recreational services. The total contribution agritourism makes is underrepresented by these statistics because related direct sales and rental incomes are not included. In addition, income from businesses that have a separate legal existence from the farm or ranch may not be included. Further, related sales that may occur at non-agricultural establishments in the region are not considered here.

Lattin Farms

Visitors to Lattin Farms in Fallon, Nev. can enjoy a hayride around the farm, a walking antique tour, multiple flower and herb gardens, a 10-acre pumpkin patch and a spacious picnic and barbeque area. In addition to the complete farm ambience, Lattin Farms is home to one of the largest corn mazes in the state. This fiveacre attraction is open annually from August through October, while the corn is high. Each year, the challenging corn maze takes on a new theme.

Table 1. Farm/Ranch-Related Income for Nevada Counties

| County |

Farms Reporting Recreation Income (#) |

Farm Recreational Income ($) |

Recreational Income/Total Farm Income |

| CHURCHILL |

4 |

$28,000 |

0.05% |

| CLARK |

1 |

(D) |

|

| DOUGLAS |

0 |

- |

|

| ELKO |

9 |

$144,000 |

0.31% |

| ESMERALDA |

0 |

- |

|

| EUREKA |

2 |

(D) |

|

| HUMBOLDT |

16 |

$94,000 |

0.16% |

| LANDER |

1 |

(D) |

|

| LINCOLN |

4 |

(D) |

|

| LYON |

2 |

(D) |

|

| MINERAL |

0 |

- |

|

| NYE |

1 |

(D) |

|

| PERSHING |

3 |

$6,000 |

0.02% |

| STOREY |

0 |

- |

|

| WASHOE |

5 |

$35,000 |

0.19% |

| WHITE PINE |

7 |

$115,000 |

0.15% |

| CARSON CITY |

0 |

- |

|

Sources: USDA, National Agricultural Statistics Service, 2002 Census of Agriculture – County Data, “Table 6. Income From Farm-related Sources: 2002 and 1997”, (D) Withheld to avoid disclosing data for individual farms

Table 2 shows the value of farm or ranch direct sales of agricultural commodities to customers in 1997 and 2002. Direct sales may take place on the farm at roadside stands or offfarm at farmers’ markets. Direct sales can often be linked to agritourism activities. Although still a modest proportion of total sales of agricultural commodities, most Nevada counties experienced an increase in value of direct farm sales over the period. Of interest in Table 2 are the growth rates in direct sales in the urban counties of Washoe and Clark at 719 % and 117% respectively. The rural counties of Elko, Douglas, Humboldt, Lander and Lyon also experienced large increases in direct sales income, while Churchill and Nye counties experienced significant drops in direct sales incomes. Increases in sales likely reflect the growing popularity of farmers’ markets and buying locally produced food as well as some agritourism revenues. Proximity to an urban area is clearly an advantage in this type of direct sales market.

Link to Table 2

Regional Data on Agritourism

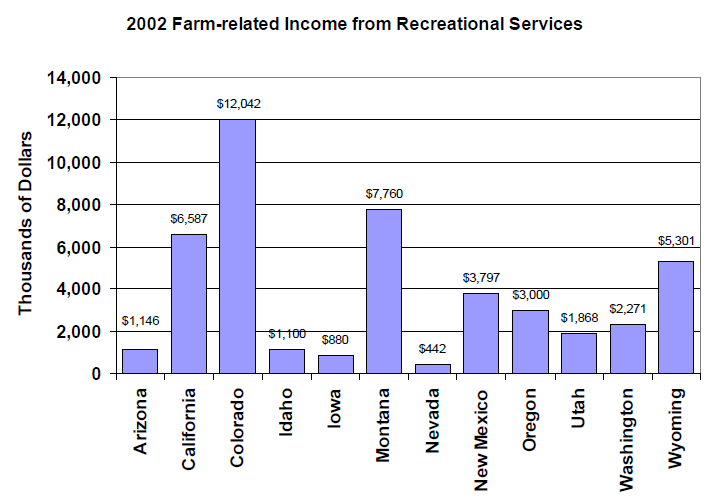

Figure 1 gives farm-related income from recreational services for the western states. As reported earlier in the fact sheet, Nevada reported a total of $442,000 in farm-related income, the lowest of all western states. The three states reporting the highest farm income from recreational services are the Rocky Mountain states of Colorado, Montana and Wyoming with $12.0, $7.8 and $5.3 million in reported farm-related income from recreational services. The reported statistic captures revenues related to hunting, fishing and other wildlife-related services better than other types of agricultural recreation. The scenic areas of the Rocky Mountains may provide a draw for this type of tourism. Research done at Colorado State University indicates that counties with high amenity values such as mountainous terrain, forested area and open water will have higher income from recreational services. In addition, they found that even when controlling for amenities and proximity to urban areas, counties that were more isolated and remote had larger recreational services incomes. A niche apparently exists for farmers or ranchers who provide the wildlife-oriented tourist access to remote regions. This may present an opportunity for some ranchers in isolated areas of rural Nevada who can provide hunters, anglers or wildlife aficionados access to wildlife and remote rural areas.

Figure 1. 2002 Farm-related Income from Recreational Services for Western States

Data From Figure 1

National Data of Agritourism

The 2000 National Survey on Recreation and the Environment, sponsored by multiple agencies within the USDA, provides information about the characteristics of the typical agritourist. About 32% of the 20,010 respondents in the survey had participated in on-farm recreation. The average farm visitor traveled a distance of 86 miles and spent $45 on the trip. Sixty-two percent of the farm tourists had learned about the farm they visited through word-of-mouth. Seven percent found out about the farm because they happened to pass by and ten percent learned about the farm because they had seen an advertisement or seen a report in the newspaper, magazines, TV, radio or some other medium. Nineteen percent visited as part of an organized group. The most popular activities reported were:

- Petting farm animals (67%)

- Hayrides or corn mazes (24%)

- Horseback riding (15%)

- Milking a cow (10%)

information about the characteristics of the typical agritourist. About 32% of the 20,010 respondents in the survey had participated in on-farm recreation. The average farm visitor traveled a distance of 86 miles and spent $45 on the trip. Sixty-two percent of the farm tourists had learned about the farm they visited through word-of-mouth. Seven percent found out about the farm because they happened to pass by and ten percent learned about the farm because they had seen an advertisement or seen a report in the newspaper, magazines, TV, radio or some other medium. Nineteen percent visited as part of an organized group. The most popular activities reported were:

- Rural scenery (76%)

- Visiting family or friends (56%)

- Learning about where our food comes from (49%)

- Watching or participating in farm activities (43%)

- Purchasing agricultural products at the farm (31%)

Challenges and Opportunities for Nevada Agritourism

In the United Kingdom and other parts of Europe, over one-third of all farm businesses have non-traditional agricultural enterprises.

The increased urbanization of these regions may increase the novelty of and desire to reconnect to agriculture. As population growth in the United States and the world continues, Nevada’s open spaces will become more valuable, creating opportunities for rural businesses. Farms and ranches near urban concentrations have opportunities for attracting nearby city customers, while agricultural enterprises in more remote locations may have a niche opportunity to attract tourists interested in hunting, fishing or other wildlife-oriented experiences in remote regions.

Agritourism ventures are not a guarantee of high returns. Just as with the creation of any other small business, success requires careful research, planning and management. Tourism of any kind can bring negative side-effects which may be minimized with careful forethought. To help address the unique challenges and opportunities of agritourism, many communities are forming new outreach and advocacy groups with farm-related tourism as a focus.

References

Wilson, Joshua, Dawn Thilmany and Martha Sullins. “Agritourism: A Potential Economic Driver in the Rural West.” EDR 06-01 Economic Development Report, Colorado State University Cooperative Extension. Department of Agricultural and Resource Economics, Ft. Collins, CO, 2006.

Economic Research Service, U.S. Department of Agriculture. National Survey on Recreation and the Environment. Agricultural Recreation Module, 2000.

Bernardo, Dan, Luc Valentin and John Leatherman. “Agritourism: If We Build It, Will They Come?” 2004 Risk and Profit Conference. August 2004, Manhattan, KS.

U.S. Department of Agriculture. 2002. Census of Agriculture. National Agricultural Statistics Service, Washington, D.C.

Table 2. Farm/Ranch Direct Sales Income 1997 and 2002

| County |

Direct Farm Sales 1997 ($) |

% of Total Sales, 1997 |

Direct Farm Sales 2002 ($) |

% of Total Sales 2002 |

Growth Rate 1997 to 2002 |

| CHURCHILL |

210,000 |

0.54% |

142,000 |

0.28% |

-32.38% |

| CLARK |

254,000 |

1.33% |

551,000 |

3.24% |

116.93% |

| DOUGLAS |

- |

0.00% |

48,000 |

0.53% |

New sales 2002 |

| ELKO |

15,000 |

0.03% |

49,000 |

0.11% |

226.67% |

| ESMERALDA |

- |

0.00% |

- |

No sales |

NA |

| EUREKA |

- |

0.00% |

- |

0.00% |

NA |

| HUMBOLDT |

33,000 |

0.06% |

59,000 |

0.11% |

78.79% |

| LANDER |

11,000 |

0.09% |

33,000 |

0.16% |

200.00% |

| LINCOLN |

6,000 |

0.08% |

7,000 |

0.06% |

16.67% |

| LYON |

53,000 |

0.10% |

200,000 |

0.27% |

277.36% |

| MINERAL |

- |

0.00% |

- |

0.00% |

NA |

| NYE |

52,000 |

0.19% |

21,000 |

0.09% |

-59.62% |

| PERSHING |

3,000 |

0.01% |

3,000 |

0.01% |

0.00% |

| STOREY |

- |

0.00% |

- |

No sales |

NA |

| WASHOE |

57,000 |

0.25% |

467,000 |

2.63% |

719.30% |

| WHITE PINE |

11,000 |

0.13% |

15,000 |

0.02% |

36.36% |

| CARSON CITY |

- |

0.00% |

- |

0.00% |

NA |

Sources: USDA, National Agricultural Statistics Service, 2002 Census of Agriculture – County Data, “Table 2. Market Value of Agricultural Products Sold Including Direct and Organic: 2002 and 1997”, UCED Analysis NA – Not applicable.

Source: USDA, National Agricultural Statistics Service, 2002 Census of Agriculture – U.S. State Data Table 7. “Income From Farmrelated sources: 2002 and 1997”.

Curtis, K., Fadali E., and Harris, T.

2007,

Potential for Agritourism in Nevada,

Extension | University of Nevada, Reno, FS-07-31