Introduction

This fact sheet is the second of five separate University of Nevada Cooperative Extension fact sheets exploring different local economic development funding tools in Nevada. This second fact sheet explores the related impact and legal aspects of the use of Tax Increment Areas (TIAs) in the State of Nevada.

Nevada Revised Statutes (NRS) 278C “Tax Increment Areas” contains the legal structure of TIAs and other related state regulations on the purpose, the creation and the activities of local TIAs in Nevada.

Current Use

Table 1 presents the total number of local TIAs and the combined total amount of revenue generated from all TIAs in each county in Nevada according to the individual county treasurer in each county located throughout the State of Nevada for FY 2011 and FY 2012. Despite several attempts to aquire the data, data on existing TIAs for Chruchill, Esmeralda, Lyon, Mineral, Nye, Pershing and White Pine counties was not avaible.

Table 1: Total Number and Total Value of all TIAs Active in Nevada FY 2011 and FY 2012

| County |

Number of Active TIAs FY 2010 |

Number of Active TIAs FY 2011 |

Revenue Generated From all Active TIAs FY 2010 |

Revenue Generated From all Active TIAs FY 2011 |

| Carson City |

0 |

0 |

$0 |

$0 |

| Churchill County |

N/A |

N/A |

N/A |

N/A |

| Clark County |

5 |

5 |

$13,764,934 |

$8,808,175 |

| Douglas County |

0 |

0 |

$0 |

$0 |

| Elko County |

0 |

0 |

$0 |

$0 |

| Esmeralda County |

N/A |

N/A |

N/A |

N/A |

| Eureka County |

0 |

0 |

$0 |

$0 |

| Humboldt County |

0 |

0 |

$0 |

$0 |

| Lander County |

0 |

0 |

$0 |

$0 |

| Lincoln County |

0 |

0 |

$0 |

$0 |

| Lyon County |

N/A |

N/A |

N/A |

N/A |

| Mineral County |

N/A |

N/A |

N/A |

N/A |

| Nye County |

N/A |

N/A |

N/A |

N/A |

| Pershing County |

N/A |

N/A |

N/A |

N/A |

| Storey County |

0 |

0 |

$0 |

$0 |

| Washoe County |

1 |

1 |

$380,023 |

$293,023 |

| White Pine County |

N/A |

N/A |

N/A |

N/A |

| Total |

6 |

6 |

$14,145,021 |

$9,106,198 |

Source: Individual County Treasurer Offices, State of Nevada

Based on available data, in FY 2010 and FY 2011, there were only six total TIAs in operation statewide, with five of those six TIAs in Clark County and one of those six TIAs in Washoe County. Statewide, the combined amount of revenue generated from all six TIAs declined from approximately $14.2 million in FY 2010 to approximately $9.1 million in FY 2011, a net decline of approximately $5.0 million or 35.6 percent.

Purpose

The provisions in NRS 278C “Tax Increment Areas” establish the authority for local county and municipal governments to use tax increment financing for the primary purpose of financing specific types of infrastructure projects that are determined to be critical to attracting new economic development projects to a community. Both redevelopment (NRS 279) and Tax Increment Areas (TIAs, NRS 278C) rely on the use of tax increment financing. However, whereas NRS 278C provides direct authority to the governing body only, while acting on its own behalf, to adopt an ordinance creating a TIA, NRS 279 requires the local governing body to first establish a redevelopment agency. With TIAs, the local county or municipal government is directly responsible for all policy and administrative decisions pertaining to the TIA, but under NRS 279, a redevelopment agency is directly responsible for all policy and administrative decisions pertaining to the redevelopment district.

The authorizing local governing board does not have to make any findings of blight to establish a TIA. NRS 278C only requires that the local governing board finds that the establishment of a TIA to fund a specific type of infrastructure as permitted in the statute is necessary and that the authorization of a TIA be primarily associated with undeveloped land where basic infrastructure improvements will make that undeveloped land within the TIA more attractive to new business development.

Creation and Use

Before the governing board of a county or municipality considers whether or not to create a TIA, NRS 278C.150 prohibits a county or municipality from creating a TIA in any area that is already defined as the following:

- The right-of-way of a railroad company that is under the jurisdiction of the Surface Transportation Board must not be included in a Tax Increment Area unless the inclusion of the property is mutually agreed upon by the governing board and the railroad company.

- A Tax Increment Area may not include a property that is, at the time the boundaries of the Tax Increment Area are created, included within a redevelopment area previously established pursuant to the laws of this State.

- The taxable property of a Tax Increment Area must not be included in any subsequently created Tax Increment Area until at least 50 years after the effective date of creation of the first Tax Increment Area in which the property was included.

Only a proper procedural order, adopted by the governing board of the creating county or municipality, can create a TIA. NRS 278C.160 outlines the steps and procedures a governing board must follow in order to create a TIA:

- Whenever the governing body of a municipality is of the opinion that the interests of the municipality and the public require an undertaking, the governing body, by resolution, shall direct the engineer to prepare (a) a preliminary plan and preliminary estimate of the undertaking, (b) a statement of the proposed Tax Increment Area that should include the last finalized amount of the assessed valuation of taxable property in the proposed TIA, and (c) a statement of the estimated amount of potential tax proceeds over the estimated duration of the TIA.

- The resolution (provisional order) must describe the undertaking in general terms and must state (a) what portion of the expense of the undertaking will be paid with the proceeds of securities issued by the municipality in anticipation of tax proceeds to be credited to the TIA account and payable wholly or in part, (b) how the remaining portion of the expense of the undertaking, if any, is to be financed, and (c) the basic security and any additional security for the payment of securities of the municipality pertaining to the undertaking.

- The resolution (provisional order) must designate the TIA or its location, so that the various tracts of taxable real property and any taxable personal property can be identified and determined to be within or without the proposed TIA, but need not describe in minute detail each tract of real property proposed to be included within the TIA.

- The engineer shall file with the clerk the preliminary plans, estimate of costs and statements.

- Upon the filing of the preliminary plans, estimate of costs and statements with the clerk, the governing body shall examine these items and if the governing body approves all of them, it shall by resolution provisionally order the creation of the Tax Increment Area.

Powers and Activities

NRS 278C.140 defines the specific infrastructure projects that may be funded using tax increment financing as part of a TIA, including:

- In the case of counties: a drainage and flood-control project (as defined by NRS 244A.027), an overpass project (NRS 244A.037), a sewerage project (NRS 244A.0505), a street project (NRS 244A.053), an underpass project (NRS 244A.055) or a water project (NRS 244A.056).

- In the case of cities: a drainage and flood-control project (as defined by NRS 268.682), an overpass project (NRS 268.700), a sewerage project (NRS 268.714), a street project (NRS 268.722), an underpass project (NRS 268.726) or a water project (NRS 268.728).

- In the case of a city with respect to any Tax Increment Area created pursuant to a cooperative agreement between the city and the Nevada System of Higher Education pursuant to NRS 278C.155, in addition to the projects described above for cities, a project for any other infrastructure project necessary or desirable for the principal campus of the Nevada State College that is approved by the Board of Regents for the University of Nevada; or an educational facility or other capital project for the principal campus of the Nevada State College that is owned by the Nevada System of Higher Education and approved by the Board of Regents of the University of Nevada.

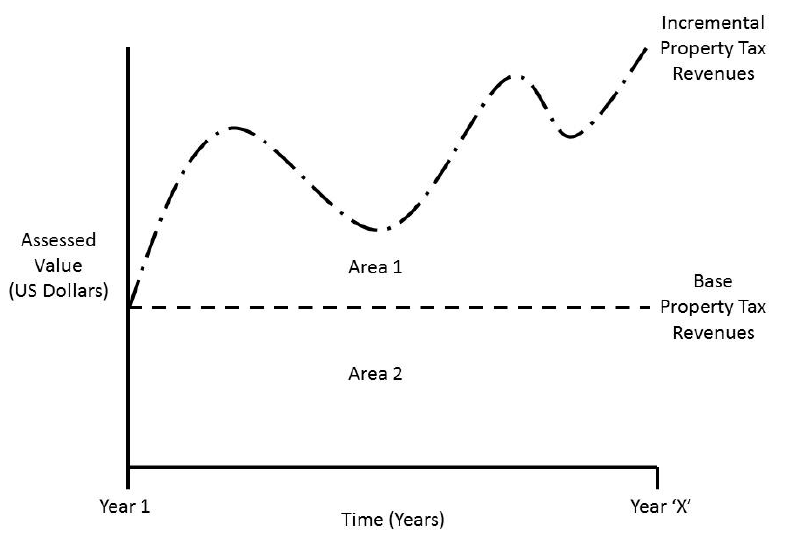

Like the use of tax increment financing for redevelopment, the single most important power of a TIA is the ability to collect incremental property tax revenues from the designated Tax Increment Area and use those revenues to fund the various infrastructure projects listed above in NRS 278C.140. Figure 1 below provides a basic illustration of how tax increment financing works.

Figure 1 – Tax Increment Financing

In the year in which the TIA is established, a “base” level of property tax revenues or assessed value is created. All property tax revenues collected from the TIA in this area (Area 2 in Figure 1) over the lifetime of the Tax Increment Area are distributed normally to the state, the county, the municipality, the local school district and any other jurisdiction that normally receives property tax revenues from any property located within the TIA.

All property tax revenues that are generated from properties in the TIA in excess of this base level (Area 1 in Figure 1) are distributed, with a few exceptions, only to the TIA. This demonstrates the principle that a Tax Increment Area is not a new tax. The TIA only receives property tax revenues from the designated Tax Increment Area only if the property tax base of the TIA grows over time.

NRS 278C.250 outlines all the specific provisions related to determining the base level of assessed value (and subsequent property tax revenues) for a Tax Increment Area, including the division and disposition of property tax revenues levied for the benefit of the state, county, city, school district and other jurisdictions that would normally receive property tax revenue from properties located within the TIA. Although NRS 278C.250 is a relatively long statute, the State of Nevada Legislative Counsel Bureau, Fiscal Analysis Division (2009) provided a short four-point summary of the chapter and section:

- The tax revenue that would be generated from the assessed value that existed within the Tax Increment Area prior to the creation of the Tax Increment Area is identified as the base assessed value and revenue from that base must be paid to the government entities (State, county, city, school district, or other entity) with a property tax rate levied in the Tax Increment Area.

- The taxes levied each year in excess of the base amount determined above must be allocated and paid into the Tax Increment Area account pertaining to the undertaking to pay the bond requirements of loans, money advanced to or indebtedness incurred by the municipality to finance or refinance the undertaking.

- For any fiscal year, if the total assessed value of the taxable property in the Tax Increment Area does not exceed the total base amount of assessed value established when the Tax Increment Area was created, all of the taxes levied and collected upon the taxable property in the area must be paid to the government entities (state, county, city, school district or other entity) with a property tax rate levied in the Tax Increment Area.

- When all loans, advances and indebtedness related to the undertaking have been paid, all money thereafter received from taxes upon the taxable property in the Tax Increment Area must be paid to the government entities (State, county, city, school district, or other entity) with a property tax rate levied in the Tax Increment Area. This is a key difference between redevelopment (NRS 279) and TIAs (NRS 278C). A redevelopment agency receives all incremental property tax revenues collected from its redevelopment district regardless of existing levels of indebtedness. A local governing board of a Tax Increment Area may only receive those incremental property tax revenues needed to satisfy existing levels of indebtedness. Any incremental property tax revenues collected by the local governing board of the TIA that are not used to satisfy existing levels of indebtedness must be returned to the state or other impacted jurisdictions including any impacted county government, municipal government or local school district.

Conclusion

redevelopment district regardless of existing levels of indebtedness. A local governing board of a TaxAlthough counties and municipalities have been slow to adopt and create Tax Increment Areas, TIAs can be a powerful financing tool for economic development purposes. Proper understanding of its legal structure and the use of tax increment financing is vital to properly discharging and understanding the powers of a local Tax Increment Area.Increment Area may only receive those incremental property tax revenues needed to satisfy existing levels of indebtedness. Any incremental property tax revenues collected by the local governing board of the TIA that are not used to satisfy existing levels of indebtedness must be returned to the state or other impacted jurisdictions including any impacted county government, municipal government or local school district.

References

State of Nevada. 2012. Nevada Revised Statutes Chapter 278C – Tax Increment Areas. NRS Site.

State of Nevada Legislative Counsel Bureau, Fiscal Analysis Division. 2009. Report on Tax Abatements, Tax Exemptions, Tax Incentives for Economic Development and Tax Increment Financing in Nevada. Carson City, NV.

Steinmann, F.

2013,

Funding Economic Development in Nevada: Tax Increment Areas,

Extension | University of Nevada, Reno, FS-13-30