Introduction

This fact sheet is the first of five separate University of Nevada Cooperative Extension fact sheets exploring different local economic development funding tools in Nevada. This first fact sheet explores the related impact and legal aspects of the use of redevelopment in the State of Nevada.

Nevada Revised Statutes (NRS) 279 “Redevelopment of Communities” contains the legal structure of local redevelopment agencies and other related state regulations on the purpose, the creation, and the activities of local redevelopment agencies in Nevada.

Current Use

Table 1 presents the total number of local redevelopment agencies and the combined level of total assessed value in each county in Nevada according to the Nevada Department of Taxation (2012), Division of Local Government Services for FY 2012 and FY 2013.

Table 1 Number and Total Assessed Value of Local Redevelopment Agencies Active in Nevada FY 2012 and FY 2013

| County |

Number of Active Redevelopment Agencies FY 2013 |

Total Assessed Value FY 2012 |

Total Assessed Value FY 2013 |

Actual Change FY 2012 to FY 2013 |

Percent Change FY 2012 to FY 2013 |

| Carson City |

1 |

$60,597,033 |

$50,405,900 |

-$10,191,133 |

-16.8% |

| Churchill County |

0 |

N/A |

N/A |

N/A |

N/A |

| Clark County |

6 |

$1,176,499,255 |

$1,030,444,078 |

-$146,055,177 |

-12.4% |

| Douglas County |

1 |

$73,758,625 |

$70,279,293 |

-$3,479,332 |

-4.7% |

| Elko County |

1 |

$3,538,068 |

$6,732,743 |

$3,194,675 |

90.3% |

| Esmeralda County |

0 |

N/A |

N/A |

N/A |

N/A |

| Eureka County |

0 |

N/A |

N/A |

N/A |

N/A |

| Humboldt County |

0 |

N/A |

N/A |

N/A |

N/A |

| Lander County |

0 |

N/A |

N/A |

N/A |

N/A |

| Lincoln County |

0 |

N/A |

N/A |

N/A |

N/A |

| Lyon County |

0 |

N/A |

N/A |

N/A |

N/A |

| Mineral County |

0 |

N/A |

N/A |

N/A |

N/A |

| Nye County |

0 |

N/A |

N/A |

N/A |

N/A |

| Pershing County |

0 |

N/A |

N/A |

N/A |

N/A |

| Storey County |

0 |

N/A |

N/A |

N/A |

N/A |

| Washoe County |

2 |

$253,904,054 |

$201,510,836 |

-$52,393,218 |

-20.6% |

| White Pine County |

1 |

$316,651 |

$1,046,877 |

$730,226 |

230.6% |

| Total |

12 |

$1,568,613,686 |

$1,360,419,727 |

-$208,193,959 |

-13.3% |

Source: Nevada Department of Taxation, Division of Local Government Services, “Property Tax Rates for Nevada Local Governments”, FY 2012 and FY 2013, Section E

For FY2013, there were a total of 12 active local redevelopment agencies in the State of Nevada with a combined total assessed value of approximately $1.4 billion. In FY 2013, there were six active local redevelopment agencies in Clark County alone, two active local redevelopment agencies in Washoe County, and one active local redevelopment agency in Carson City, Douglas County, and White Pine County. Between FY 2012 and FY 2013, total assessed value for all redevelopment statewide combined fell by approximately $208.2 million or 13.3 percent. Only redevelopment agencies in Elko County and White Pine County experienced positive growth in the assessed value of their local redevelopment agencies between FY 2012 and FY 2013.

Purpose

According to NRS 279.416, “It is found that there exists in many communities blighted areas which constitute either social or economic liabilities, or both, requiring redevelopment in the interest of the health, safety and general welfare of the people of those communities and of the State.” In subsequent declarations of state policy in NRS 279.418, NRS 279.420, NRS 279.422, NRS 279.424 and NRS 279.425, general purposes of redevelopment include:

- To create a tool of community revitalization and economic development powerful enough to eliminate and mitigate the growing menace of blighted areas to public health, safety and welfare, while creating benefits for the inhabitants resulting from remedying those conditions.

- To overcome the inability of individual landowners to rehabilitate property through the remedy of public acquisition.

- To provide a legal structure for the appropriate use of eminent domain as a means of eliminating blight.

- To develop an adequate supply of decent, safe and sanitary low-income housing.

In short, the primary purpose of redevelopment in Nevada is to eliminate and mitigate blight in areas defined as blighted. A “blighted area” is defined in NRS 279.388 as any area found to meet the following criteria:

- The existence of buildings and structures, used or intended to be used for residential, commercial, industrial or other purposes, or any combination thereof, which are unfit or unsafe for those purposes and are conducive to ill health, transmission of disease, infant mortality, juvenile delinquency or crime because of one or more of the following factors: defective design and character of physical construction; faulty arrangement of the interior and spacing of buildings; inadequate provision for ventilation, light, sanitation, open spaces and recreational facilities; age; obsolescence; deterioration; dilapidation; mixed character or shifting of uses.

- An economic dislocation, deterioration or disuse.

- The subdividing and sale of lots of irregular form and shape and inadequate size for proper usefulness and development.

- The laying out of lots in disregard of the contours and other physical characteristics of the ground and surrounding conditions.

- The existence of inadequate streets, open spaces and utilities.

- The existence of lots or other areas that may be submerged.

- Prevalence of depreciated values, impaired investments and social and economic maladjustments to such an extent that the capacity to pay taxes is substantially reduced and tax receipts are inadequate for the cost of public services rendered.

- A growing or total lack of proper utilization of some parts of the area, resulting in a stagnant and unproductive condition of land that is potentially useful and valuable for contributing to the public health, safety and welfare.

- A loss of population and a reduction of proper use of some parts of the area resulting in its further deterioration and added costs to the taxpayer for the creation of new public facilities and services elsewhere.

- The environmental contamination of buildings or property.

- The existence of an abandoned mine.

NRS 279.388 also contains a special provision for areas that are eligible railroad “blighted areas” as long as four of the 11 criteria listed above are met and one or more of the following additional criteria are met:

- The existence of railroad facilities, used or intended to be used for commercial, industrial or other purposes, or any combination thereof, which are unfit or unsafe for those purposes because of age, obsolescence, deterioration or dilapidation.

- A growing or total lack of proper utilization of the railroad facilities resulting in a stagnant and unproductive condition of land that is potentially useful

- and valuable for contributing to the public health, safety and welfare.

- The lack of adequate rail facilities that has resulted or will result in an economic hardship to the community.

Creation and Use

NRS 279.516 through NRS 279.609 provide a general guide outlining how a county or municipality in Nevada can create a redevelopment district and a redevelopment agency. Before any redevelopment district or redevelopment agency can be created, the local authorizing jurisdiction, per NRS 279.516, must have a legally recognized planning commission and a legally recognized master plan or general plan.

The process of establishing a local redevelopment district and local redevelopment agency begins with the designation of an area for evaluation as a redevelopment area per NRS 279.518 by a resolution of the local governing and/or legislative body. Once a study area, or area for evaluation, has been established, staff will usually begin with the development of a preliminary redevelopment plan that will identify and document the existing blighting conditions, as defined in NRS 279.388, within the study area.

Once a preliminary redevelopment plan is approved and adopted by the planning commission and the local governing and/or legislative body (county commission or city council), staff can begin with the development of the final redevelopment plan that must contain, according to NRS 279.572:

- The amount of open space to be provided and the layout of streets.

- Limitations on type, size, height, number and proposed use of buildings.

- The approximate number of dwelling units.

- The property to be devoted to public purposes and the nature of those purposes.

- Other covenants, conditions and restrictions that the legislative body prescribes.

- The proposed method of financing the redevelopment plan in sufficient detail so that the legislative body may determine the economic feasibility of the plan.

Other components of the redevelopment plan include a section describing the leases and sales of real property by the redevelopment agency (NRS 279.574) and the acquisition of property and the issuance of bonds (NRS 279.576).

According to NRS 279.519, the proposed redevelopment project area may contain contiguous or noncontiguous areas and may include lands, buildings or improvements that are not blighted but whose inclusion is found necessary for the effective redevelopment of the entire project area. At least 75 percent of the entire proposed redevelopment project area must be improved and may include public land upon which public buildings have been erected or improvements have been constructed and land on which an abandoned mine, landfill or similar use is located and that is surrounded by or directly abuts the improved land.

According to NRS 279.580, prior to adoption of the final redevelopment plan by the governing and/or legislative body by ordinance, the governing body must consider all evidence for or against the plan during a public hearing where staff must present the final redevelopment plan and a report that must include the following:

- The reasons for the selection of the redevelopment area.

- A description of the physical, social and economic conditions in the area.

- A description of the proposed method of financing the redevelopment plan in sufficient detail so that the legislative body may determine the economic feasibility of the plan.

- A method or plan for the relocation of persons and families temporarily or permanently displaced from housing facilities in the redevelopment area.

- An analysis of the preliminary plan.

- The report and recommendations of the Planning Commission, if any.

Upon adoption of the final redevelopment plan by the Planning Commission and the local governing and/or legislative body, the now established redevelopment agency can now begin the process of redeveloping and revitalizing the now established redevelopment project area (or district).

Powers and Activities

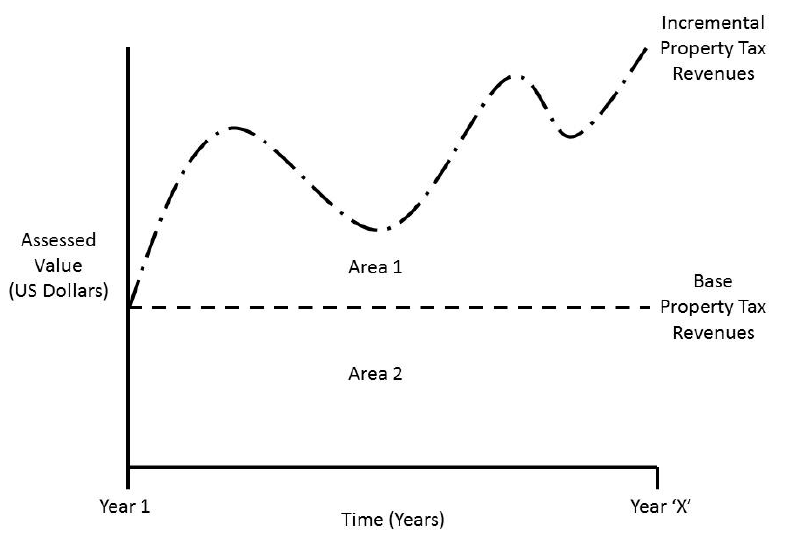

The most important power of redevelopment in Nevada is the ability to collect incremental property tax revenues from the redevelopment district and reinvest them back into the project area in a process known as tax increment financing. Figure 1 provides an illustration of how tax increment financing works. In the year in which the redevelopment district (agency) is established, a “base” level of property tax revenues or assessed value is created. All property tax revenues collected from the redevelopment district in this area (Area 2 in Figure 1) are distributed normally to any other jurisdiction that would normally receive property tax revenues from any property located within the redevelopment district.

Figure 1 – Tax Increment Financing

All property tax revenues that are generated from properties in the redevelopment district in excess of this base level (Area 1 in Figure 1) are distributed, with a few exceptions, to only the redevelopment agency. This demonstrates that redevelopment is not a new tax. The agency will only receive property tax revenues from the district if the property tax base of the redevelopment district grows over time.

Once the redevelopment district expires, other jurisdictions (the state, county, municipality, school district, etc.) that did not receive property taxes from the incremental growth in property values in the redevelopment district begin to receive property tax revenues from the new property tax base that grew as a result of redevelopment activities within the district.

NRS 279.432, NRS 279.470 and NRS 279.486 outline several of the major activities a public body (a state agency, county or municipal government) can take to aid a redevelopment agency and some of the general ways in which a redevelopment agency can permissibly use its incremental property tax revenues.

NRS 279.432 states that another public body (a state agency, county or municipal government) may:

- Dedicate, sell, convey or lease any of its property to a redevelopment agency.

- Cause parks, playgrounds, recreational, community, educational, water, sewer or drainage facilities, or any other works that it is otherwise empowered to undertake, to be furnished adjacent to or in connection with redevelopment projects.

- Furnish, dedicate, close, pave, install, grade, regrade, plan or replan streets, roads, roadways, alleys, sidewalks or other places that it is otherwise empowered to undertake.

- Plan, replan, zone or rezone any part of such area and make any legal exceptions from building regulations and ordinances.

- Enter into agreements with the federal government respecting action to be taken by such public body pursuant to any of the powers granted by NRS 279.382 to NRS 279.685, inclusive.

NRS 279.470 states that, in regard to the acquisition, management, disposal and encumbrance of interests in real and personal property, a redevelopment agency may:

- Purchase; lease; obtain option upon or acquire by gift, grant, bequest, devise or otherwise; any real or personal property, any interest in property and any improvements thereon.

- Except as otherwise provided in NRS 279.471 and NRS 279.4712, acquire real property by eminent domain.

- Clear buildings, structures or other improvements from any real property acquired.

- Sell; lease; exchange; subdivide; transfer; assign; pledge; encumber by mortgage, deed or trust or otherwise; or otherwise dispose of any real or personal property or any interest in property.

- Insure or provide for the insurance of any real or personal property or operations of the agency against risks or hazards.

- Rent, maintain, manage, operate, repair and clear such real property.

NRS 279.486 contains general provisions regarding the purchase and construction of certain buildings, facilities and improvements by the redevelopment agency or by any other governmental entity in support of the redevelopment agency’s efforts in and around the redevelopment district. “An agency may, with the consent of the legislative body, pay all or part of the value of the land and the cost of the construction of any building, facility, structure or other improvement and the installation of any improvement which is publicly or privately owned and located within or without the redevelopment area.”

Conclusion

Redevelopment is a powerful local economic development tool in Nevada. Proper understanding of its legal structure and the use of tax increment financing is vital to properly discharging and understanding the powers of a local redevelopment agency.

References

Nevada Department of Taxation. 2011. Property Tax Rates for Nevada Local Governments: Fiscal Year 2011-2012. State of Nevada: Division of Local Government Services.

Nevada Department of Taxation. 2012. Property Tax Rates for Nevada Local Governments: Fiscal Year 2012-2013. State of Nevada: Division of Local Government Services.

State of Nevada. 2012. Nevada Revised Statutes Chapter 279 – Redevelopment of Communities. NRS Site.