Introduction

In 2004, the members of the Nevada Wildland Seed Producers Association (NWSPA) requested that a study be conducted to assess the feasibility of a business cooperative of Nevada native plant/seed producers. The proposed cooperative would be organized to grow, process, package, and market native Nevada plants, grasses, and forbs. Native seed production and collection is still in its infancy in Nevada, and as such, the local market for native products has not been fully explored. In the past, growers provided plants and seeds primarily to government agencies, such as the Bureau of Land Management (BLM). However, agency demand for these products is determined primarily by the current fire restoration efforts, resulting in large fluctuations in demand from year to year. The native seed growers in Nevada, as well as their primary customers, requested this study in order to evaluate the potential markets for their products.

The study (Curtis et al., 2005) found that only a small percentage of native plants and seeds purchased in Nevada are grown/started in Nevada, although survey respondents did express a willingness to pay a premium for native plant and seed products certified as “Nevada Grown.” It was also found that respondents are influenced by the quality of native plant and seed products and the service they receive from their vendors, in addition to the price of the product.

Who Benefits From the Use of Native Plants/Seeds?

State and federal organizations, mining companies, agriculture, landscaping companies, nurseries, florists, and health and beauty supply producers can all benefit from the use of native plants and seeds.

Restoring the Land: Government Agencies and Mining Companies

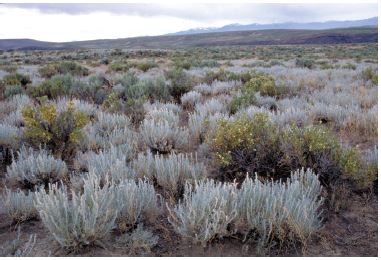

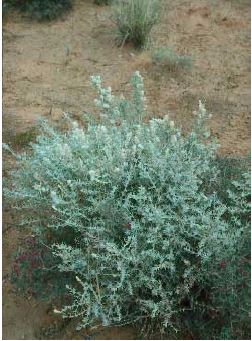

The arid climate in Nevada causes the landscape to be prone to severe drought, wildfires, and highly erodible soils. Recent wildfires and the erosion of soils, due in part to mining, have brought about an increase in invasive plant species, raising the need for the restoration of public and private lands. Native grasses and forbs provide perennial protection for soils and are drought resistant, flourishing well in Nevada’s climate. Government agencies, including the United States Forest Service (USFS), the Nevada Department of Transportation (NDOT), Nevada Department of Fish and Wildlife, the BLM, and the Nevada Division of Forestry (NDF), as well as mining and restoration operations, currently use native seed and plants for the restoration of thousands of acres each year in the Great Basin.

Stalling Invasive Weeds: Agriculture

Noxious weeds are an increasing concern in Nevada. The agricultural community in Nevada can benefit from the use of native grasses and forbs in the treatment of invasive weeds, as propagation through dense native plants is difficult for invasive species. Hence, planting native grasses, plants, and forbs after weed treatments has proven to be successful in keeping invasives at bay.

Creating a Natural Appearance: Landscapers, Nurseries, and Florists

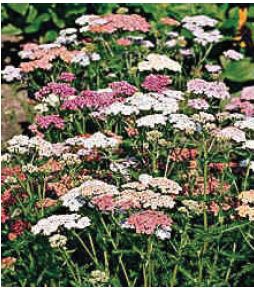

Local landscaping and nursery industries benefit from the use of native Nevada grasses and forbs through the offering of drought resistant, attractive landscaping material for private, public, and recreational foliage. Native plants fit well with the natural environment surrounding landscaped areas, providing an appealing alternative to non-natives. Because of this, landscaping companies and nurseries are a natural distribution channel for native plant and seed products. Florists in Nevada often use native grasses and forbs in floral and plant arrangements as a cost-effective and aesthetically pleasing alternative to non-native species.

Niche Marketing: Health Food and Beauty Supply Companies

Lastly, native grasses and forbs are currently used in health food and beauty products around the world. Gluten-free flour and baking additives are made from Indian ricegrass, which contains high levels of fiber and protein. Wheatgrass juice is thought to aid in neutralizing toxins and carcinogens in the body, leading some to believe the juice may improve blood sugar disorders, help prevent tooth decay, increase hemoglobin production, keep hair from graying, improve digestion, reduce high blood pressure, and aid in the prevention and recovery of cancer. Triterpenoids extracted from Stansbury cliffrose have been shown to have inhibitory effects on HIV and Epstein-Barr virus (Utah State University Extension, 2004), while globemallow is used to treat early stages of bronchial distress and urinary tract infections (Tucson Clinic of Botanical Medicine, 2002).

Market Survey Results

To gain an understanding of the market demand for native plants and seeds, a survey was mailed to a random sampling of businesses and agencies that may use native plants and seeds. The surveys were sent to florists, mining companies, reclamation companies, government agencies, nurseries, landscaping companies, and producers of natural health and beauty supplies. With the exception of the health and beauty suppliers, all of the companies surveyed were either based or had a location in Nevada. The health and beauty suppliers were located across the United States, but the majority of the surveyed companies were located in California. A total of 41 valid responses were returned out of the 935 surveys mailed out, for a response rate of 4.4%.

The majority of responses were returned by landscaping companies, representing 36% of total responses, and nurseries, representing 34% of total responses (Figure 1). Fifteen percent of respondents were mining companies, while the remaining portion of the population was composed of 5% each of federal agencies, florists, and health food/beauty product supply companies.

Respondents were asked to describe their plant use versus their seed use, so their preferences could be better understood (Figure 2). As expected based on the population, plant use and seed use was fairly equal among respondents, with a slight emphasis on the use of seeds over plants. Nine respondents (45% of respondents who answered the question) said they use only plants, one respondent (5%) said his/her organization uses both plants and seeds in equal amounts, three respondents (15%) said they use both, but use more seeds than plants, and seven respondents (35%) said their organization uses only seeds. One respondent (5% of total population) did not answer the question.

Influential Factors in Native Plant and Seed Purchases

In order to better understand what attributes or factors of native plants and seeds appeal most to customers of these products, respondents were given a list of factors that may affect their decisions when considering potential plant and seed purchases. Respondents were asked to rate the influence of these factors on their plant and seed product purchasing decisions. The results of this rating are in Figures 3-9.

Cost is often a motivating factor in business decisions. As such, respondents were asked to rate the influence of the product's price when considering a plant/seed purchase (Figure 3). Nearly all of the respondents who answered this question, 97% (30 respondents), rated price as a more influential factor in their purchasing decisions, while the other 3% (one respondent) said price is only somewhat influential on their purchasing decisions. No respondents rated price as a less influential factor. Ten respondents (24% of total population) did not answer this question.

The quality of plants and seeds may include such factors as germination percentage, heartiness, and survivability. Respondents were asked to rate the influence of the quality of the plant/seed product on their purchasing decision (Figure 4). Nearly all of the respondents who answered this question, 97% (28 respondents), rated the product's quality as a more influential factor on their plant/seed purchasing decisions, while the remaining 3% (one respondent) of respondents said quality was somewhat influential. No respondents rated quality as less important. Twelve respondents (28% of total population) did not answer the question.

Over time, the quality of service received from a vendor can have a lasting impact on customers. Respondents were asked to rate the influence of receiving high-quality service from the plant/seed supplier when they are considering making a plant or seed purchase (Figure 5). The majority of the respondents who answered this question, 75% (21 respondents), rated service as a more influential aspect of their plant and seed purchases, while the remaining 25% (seven respondents) rated service as being somewhat influential on their purchasing decisions. No respondents rated service as less influential. Thirteen respondents (32% of total population) did not answer this question.

With the limited amount of time available for planting and using plants and seeds, respondents who purchase these products may be interested in finding a supplier with a location convenient to their business. Respondents were asked to rate the influence of this sort of convenience on their purchasing decisions (Figure 6). More than half of the respondents who answered this question, 60% (15 respondents), rated convenience as a more influential aspect, while 28% (seven respondents) rated it as somewhat influential, and the remaining 12% (three respondents) rated convenience as a less influential aspect of their plant and seed purchasing decisions. Sixteen respondents (39% of the total population) did not answer this question.

As with convenience, the method of delivery can have an effect on a customer's choice of plant and seed suppliers, so respondents were asked to rate the influence of the delivery method of the plant/seed product on their purchasing decisions (Figure 7). While 39% of respondents (nine respondents) rated delivery method as a more influential factor, another 39% (nine respondents) rated it as only somewhat influential. The remaining 22% of respondents (five respondents) rated delivery methods as a less influential factor on their plant/seed purchasing decisions. Eighteen respondents (43% of total population) did not answer this question.

Having a relationship with a supplier may be important to plant and seed product consumers. Respondents were asked to rate the influence of having a relationship with the supplier on their purchasing decisions (Figure 8). The responses were more evenly divided on this issue, with 38% (eight respondents) of respondents rating having a relationship as a more influential factor, 33% (seven respondents) rating it as somewhat influential, and the remaining 29% (six respondents) rating it as a less influential factor. Twenty respondents (48% of total population) did not answer this question.

Maintaining a contract with a vendor is one way for companies to ensure a certain level of security in their transactions. Respondents were asked to rate the influence of maintaining a contract with a supplier on their plant and seed purchasing decisions (Figure 9). More than half of the respondents who answered this question, 55% (12 respondents), rated contracts as a less influential aspect on their purchasing decisions, while 36% (eight respondents) of respondents rated contracts as being somewhat influential. Only 9% (two respondents) of respondents rated contracts as being a more influential aspect of their purchasing decisions, indicating that contracts are not very important to the respondents of this survey, who may be more interested in having a relationship with their vendors than a contract. Nineteen respondents (46% of total population) did not answer the question.

Tables 1 and 2 show the importance of each factor for plants and seeds individually, rather than in aggregate. For plants, price was found to be the most influential factor, with 100% of respondents rating it as a more influential factor. Quality was second in importance, with 97% of respondents rating it as a more influential factor. The service received from the plant supplier was given the third highest rating, with 73.3% of respondents rating service as a more influential factor, followed by the convenience of the supplier's location, with 57.1% of respondents rating this as a more influential factor. The delivery method used by the supplier and existence of a relationship with the supplier were closely rated, with 44.4% and 43.5% of respondents rating these as more important factors, respectively. The existence of a contract between respondent and supplier was given the lowest influence rating by far, with a mere 4.2% of respondents rating contracts as a more influential factor.

For seeds, the factors were given similar importance rankings, with the exception of quality, which was found to be the most influential purchasing factor among respondents, with 96% rating it as a more influential factor. Price was found to be the second most influential factor among seed purchasing respondents, with 92.9% of respondents rating price as a more influential factor. Seed producers should note that quality was given a slightly higher importance rating than price, indicating that the quality of a seed product may carry more weight than the price of the product in the market. This may also indicate that customers are willing to pay a premium for a seed product of high quality. Service was given the third highest rating, with 79.2% of respondents rating the service received from a seed supplier as a more influential aspect. The convenience of the supplier's location was given the next highest rating, with 63.3% of respondents rating convenience as a more influential factor. The delivery method used by the supplier and having a prior relationship with the supplier were tied with 30% of respondents rating these attributes as having a high level of influence on their purchasing decisions. Contracts were seen as slightly more important to seed purchasers than plant purchasers, with 15% of the population rating the existence of a contract as a more influential factor on their purchasing decisions.

Plant and Seed Purchases from Nevada Sources

Respondents were asked to describe the percent of their total annual plant and seed usage that comes from their own nursery, nurseries owned by another party, and from wholesalers. They were also asked to indicate what percentage of their purchases came from Nevada sources. Table 3 shows that 18.9% of total plant usage (13,044 total plants) is produced in Nevada, whether purchased or grown by the respondent's company. For seeds, it was found that 14.3% of total usage (19,375 pounds of seed) was produced in Nevada. Over both plants and seeds, 16.6% of total usage was produced in Nevada.

Respondent's Willingness to Pay For Nevada Plant/Seed Products

Finally, respondents were presented with a hypothetical situation where they would have the choice between purchasing a standard one gallon native plant, or the same product distinguished from the first by a "Nevada Grown" label. The respondents were then presented with a series of price premiums, or bids, ranging from 10% over the price of the standard product to 100% of, or double, the standard product price. Respondents were given the option of saying they would pay the premium amount, would not pay the premium amount, or that they were uncertain whether or not they would pay the premium.

The results of this question are summarized in Table 4, which shows the percentage of respondents who would definitely pay the premium amount, the percent who would definitely not pay the premium, and the percentage of respondents who were not sure whether or not they would pay the premium amount. For example, for a 10% premium, 41.0% of respondents felt they would definitely pay that amount, while 12.9% of respondents felt they would definitely not pay the amount, and the remaining 46.2% of respondents were uncertain. This follows for all other premium amounts. For each premium amount, the total number of responses across categories is 41.

Conclusions

Although native plants and seeds are used in many industries in Nevada, the majority of the plants and seeds used by companies in the state have been purchased elsewhere. This may be due in part to the fact that the native plant and seed industry in Nevada is still in the early stages, and consumers may be unaware of the existence of the local supply.

This study found that price and quality are the most influential factors on customers’ purchasing decisions when it comes to native plants and seeds. Although these two factors were reported as having the most importance to respondents, the service received from a vendor was also given a high level of importance. This indicates that consumers of native plant and seed products are looking for a high-quality product that they can purchase from a familiar vendor who provides consistent service. Additionally, it was found that respondents were willing to pay a premium for native plants certified as having been grown in Nevada. This is further assurance that a market for locally-grown native plant products exists in Nevada.

References

Curtis, K.R., M.W. Cowee, and S.L. Slocum, (2005). “Nevada Wildland Seed Cooperative Feasibility Assessment.” University of Nevada Center for Economic Development (UCED) Publication 2005/06-10, 2005.

Tucson Clinic of Botanical Medicine (TCBMed), (2002). “Globemallow.” The Collection vol. 3, no. 4, Winter 2001-2002.

Utah State University Extension, (2004). “Range Plants of Utah: Cliffrose.” Online. Available at Utah State University.