Introduction

A mail survey of agricultural producers was conducted during autumn 2005 to assess producer interest in a potential livestock slaughter and/or processing facility in Northern Nevada. One hundred fifty-three surveys were returned, representing nearly 70 percent of total livestock producers in Northern Nevada.

The survey was divided into three sections. The first section assessed the structure and scope of the respondent’s livestock operation. The second section of the survey focused on livestock production and marketing methods and the third section sought information about the respondent’s interest in the potential facility.

Respondents were asked to describe the valley area of Northern Nevada where their operation is located. While 14 percent (22 respondents) of respondents did not specify the location of their operation, the other 86 percent were located in Northern Nevada. Surveys were returned from respondents living in the Lahontan, Carson, Mason, Smith, Washoe, Bridgeport, Dayton and Antelope Valleys, as well as the Truckee Meadows.

Respondents were asked to provide additional information regarding the title of their position with the operation, the number of years they have been in business and the number of active acres they own and lease. Of the 153 respondents, 95 percent (145 respondents) were owners/operators, 73 percent (112) had been in business 21 or more years and 12 percent (18) had been in business 11 to 20 years. The completed surveys represented a total of 4,317,870 active acres.

Production & Marketing

Annual Production

Respondents were asked to list how many and what type of animals they produce annually (Table 1). Total annual estimates came to 36,529 beef cattle, 8,933 sheep/lamb, 355 goat and 166 hogs.

Marketing

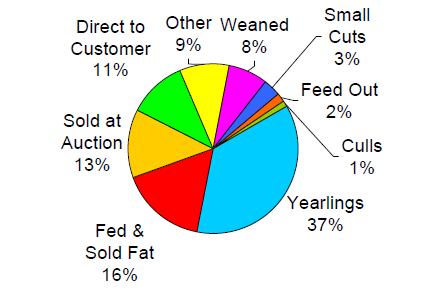

Respondents were then asked how they market their livestock products, and how many animals they market per each option (Figure 1). Thirty-six percent of respondents sell their livestock as yearlings, 17 percent have their livestock fed and sold fat, 13 percent sell their livestock at an auction, 11 percent sell directly to the customer, 8 percent sell their livestock weaned, 3 percent sell their livestock slaughtered as small cuts, 2 percent feed their livestock out and 1 percent sell culled animals. Nine percent of respondents said they sell their livestock another way but did not specify the method.

Figure 1: Marketing Methods

Data From Figure 1

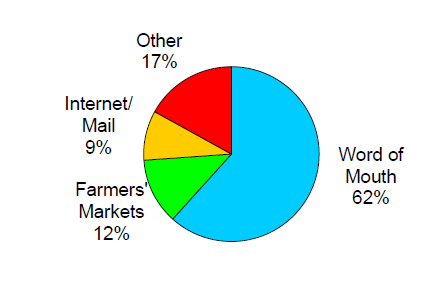

Respondents were asked to list the outlets used when marketing livestock products directly to the consumer (Figure 2). Fifty-eight percent (88) of respondents either do not use direct marketing or did not specify a method, but of the other 65 respondents, 62 percent (40) use word of mouth as a direct marketing technique, 12 percent (8) direct market at farmers’ markets and 9 percent (6) of respondents use the Internet or mail. Another 17 percent (11) of respondents who direct market use other methods, such as booths at fairs and rodeos, advertisements in trade magazines and marketing at auctions or through a broker.

Figure 2: Direct Marketing Methods

Data From Figure 2

Potential Facility Preferences

The final section of the survey presented respondents with several questions relating to their preferences for and receptivity of a future processing/slaughtering unit and/or cooperative. This section also asked respondents some questions relating to the perceived benefits of cooperatives. Respondents were asked to list the types of animals their farm or ranch would want to slaughter and/or process if a slaughtering/processing unit were available.

Respondents were asked to estimate how much of each type of livestock they would consider sending to the potential slaughtering unit (Table 2). Total estimates came to 4,055 cattle with an average weight of 800 pounds per animal for an annual average of 3,243,750 pounds; 7,122 sheep or lamb with an average weight of 150 pounds per animal for an annual average of 1,068,250 pounds; 120 goats with an average weight of 200 pounds per animal for an annual average of 24,000 pounds; and 227 hogs with an average weight of 200 pounds per animal for an annual average of 45,400 pounds.

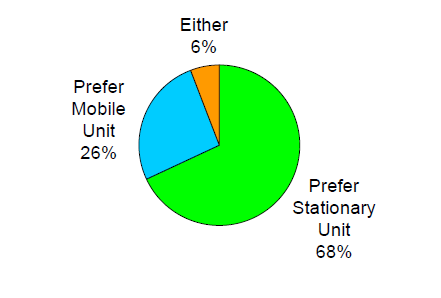

Respondents were asked if they would prefer the proposed slaughter facility be mobile or stationary (Figure 3). Sixty-eight percent (104) of respondents said they would prefer that the unit be stationary, 26 percent (40) would like it to be mobile, and 6 percent (9) have no preference between stationary or mobile.

Figure 3: Slaughter Unit Preferences

Data From Figure 3

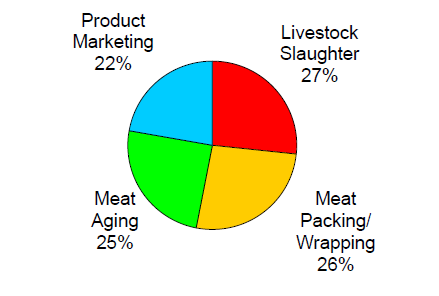

To better understand which aspects of a cooperative/business entity appeal most to livestock producers, respondents were asked to describe the functions they might want a cooperative/business entity to perform for their farm/ranch (Figure 4). Responses were fairly evenly divided over four functions: meat slaughtering, meat packing/wrapping, meat aging and marketing. Twenty-seven percent (41) of respondents listed the slaughtering of meat as a function they would like to have the entity perform, 26 percent (40) said they were interested in the entity packing and/or wrapping the finished meat, 25 percent (38) were interested in the entity having the ability to age meat and the final 22 percent (34) of respondents were interested in the entity performing marketing functions for its members.

Figure 4: Preferred Entity Functions

Data From Figure 4

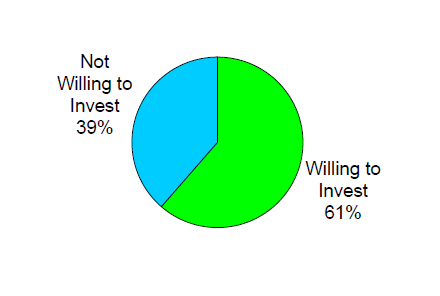

Finally, respondents were asked if they would be willing to invest in a producer business entity if it were shown to be potentially profitable (Figure 5). Sixty-one percent (94) of respondents said they would be interested in investing in the entity while the other 39 percent (59) said they would not be interested in investment.

Figure 5: Respondents Willing to Invest

Data From Figure 5

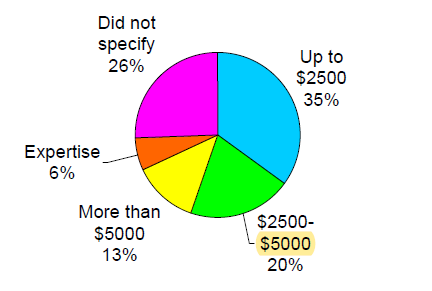

Respondents who expressed interest in investing in the entity were asked what amount they would be willing to invest, given that the business entity was proven to be a worthwhile investment of time and money (Figure 6). Thirty-five percent (33) of respondents said they were willing to invest up to $2,500 while 20 percent (19) were willing to invest between $2500 and $5,000. Another 13 percent (12) of respondents said they would be willing to invest upwards of $5,000. Six percent (6) of respondents were willing to provide the entity with their expertise as opposed to lending financial support, including expertise with various processing activities such as cutting, wrapping, skinning, etc., as well as expertise with unique livestock. Twenty-six percent (24) of respondents who said they were willing to invest did not specify a monetary amount.

Figure 6: Investment Amounts

Data From Figure 6

Conclusions

The results of this study indicate that more than 60 percent of the livestock producers responding to the survey indicated a willingness to invest money, time or both in this venture, meaning the business entity may have as many as 94 producer members at its inception. Taking the annual livestock production information and producer interest into consideration, the potential slaughter/processing/packing business entity should have the capacity to process and/or package 2,433 cattle on an annual basis or 203 cattle per month (if distributed evenly year-round); 4,262 sheep/lamb annually or 356 per month; 72 goats annually or six per month; and 136 hogs on an annual basis or 11 per month (Table 3).

Based on the investment participation rates obtained through the survey, a conservative estimate of potential start-up investment is $227,500 (91 producers at $2,500 each) while a more liberal estimate of potential starting investments is $375,500 (40 producers at $5,000 each plus 51 producers at $2,500 each).

There are two possibilities for the slaughtering/processing facility: a mobile unit or a stationary facility. Under the mobile scenario, the slaughtering function would be performed at a mobile unit with the hanging, processing and packing functions performed in a stationary unit. The feasibility of a mobile unit would depend on the number of animals to be slaughtered and/or processed.

More Information

For the full results of this study, see the University Center for Economic Development Technical Report 2006/07-13, “Locally Produced Livestock Processing and Marketing Feasibility Assessment,” by K. Curtis, M. Cowee, A. Acosta, S. Lewis, and T. Harris, available for download at Locally Produced Livestock Processing and Marketing Feasibility Assessment.